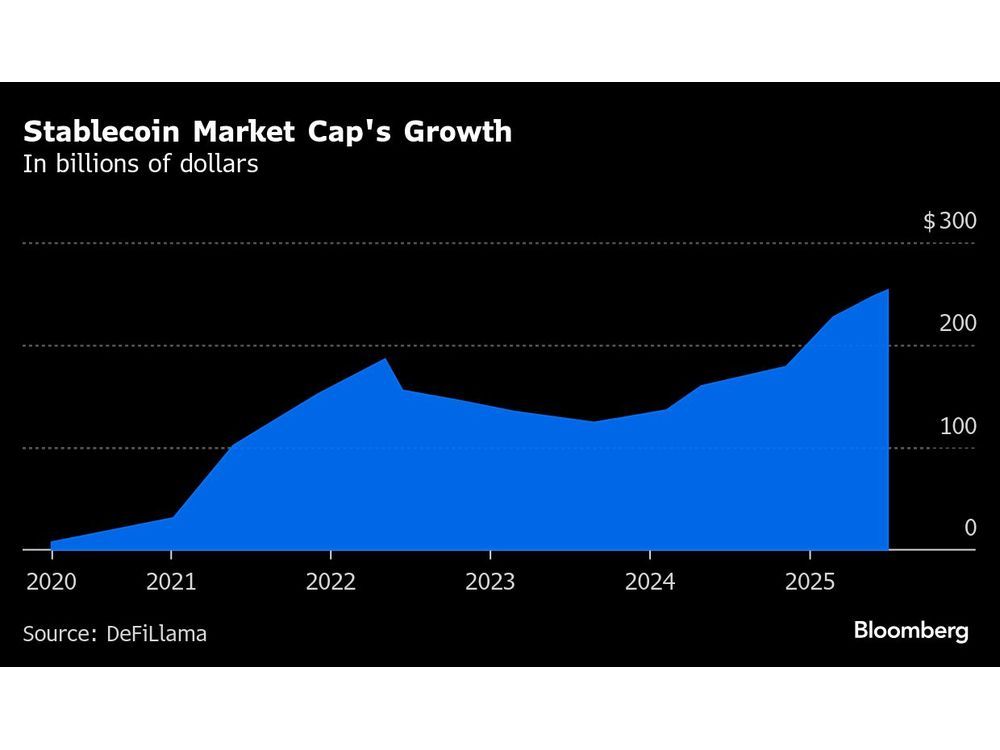

Visa, Mastercard Race to Tame a $253 Billion Crypto Threat

A turf war is breaking out in the vast world of digital payments — and the incumbents are suddenly on defense.Author of the article:Bloomberg NewsEmily Mason and Olga KharifPublished Jul 01, 20255 minute read qu64zqp89qhgr9qaw]4xyho5_media_dl_1.png DeFiLlamaArticle content(Bloomberg) — A turf war is breaking out in the vast world of digital payments — and the incumbents are suddenly on defense.THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLYSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.Daily content from Financial Times, the world's leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.SUBSCRIBE TO UNLOCK MORE ARTICLESSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.Daily content from Financial Times, the world's leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.REGISTER / SIGN IN TO UNLOCK MORE ARTICLESCreate an account or sign in to continue with your reading experience.Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.Create an account or sign in to continue with your reading experience.Access articles from across Canada with one accountShare your thoughts and join the conversation in the commentsEnjoy additional articles per monthGet email updates from your favourite authorsSign In or Create an AccountorArticle contentTech firms and crypto startups are moving in on territory long dominated by Visa Inc. and Mastercard Inc., powered by a new type of currency — the stablecoin — and a pitch merchants can’t ignore: lower fees, faster settlement and a way to bypass the big two altogether. Article contentArticle content Article contentIt’s a tech threat and a financial threat. Digital tokens, which are typically pegged to the dollar, allow consumers to pay merchants directly from their crypto wallets — without routing payments through a bank or card network. Last year alone, US businesses paid an estimated $187 billion in swipe fees, most of it via Visa and Mastercard’s systems. Stablecoins promise to make that toll much lower, or even obsolete. Article contentBy signing up you consent to receive the above newsletter from Postmedia Network Inc.Article content“It’s clear that eventually this entire space could be a threat to TradFi providers,” said Christian Catalini, founder of MIT Cryptoeconomics Lab. “But credit card networks aren’t sitting on the sidelines. The card networks will push to work with many stablecoins, so they retain their central role.”Article contentThat pressure is prompting Visa and Mastercard to brand themselves — not as old-school toll collectors — but as the backbone for all kinds of digital transactions, including those originally designed to bypass them. With President Donald Trump poised to sign the legislation that creates formal federal oversight of stablecoin issuers, they’re touting enhancements to longstanding efforts in areas including stablecoin settlement and crypto-linked cards. Visa and Mastercard have also highlighted initiatives in cross-border payments, one of the most popular use cases for stablecoins. Article content Article contentTheir influence cuts both ways. Visa and Mastercard have a long history of neutralizing competitive threats by absorbing them into their own networks, often in ways designed to preserve their pricing power. In pulling stablecoins closer, it may prove just the latest feat of co-option by the big guns, with the stablecoin market now worth $253 billion — and on course to reach $2 trillion in the next few years, according to Treasury Secretary Scott Bessent.Article contentThat stablecoins are part of the financial-disruption story marks a rare break from the crypto industry’s reputation for speculation and gambling. In that sense, stablecoins offer something radical: a tool that might actually make financial systems work better, giving the crypto community a socially useful function at long last. Article contentThat momentum is beginning to reshape corporate behavior. Mega retailers like Walmart Inc. are considering stablecoin pilots, according to the Wall Street Journal. Earlier this month, bank technology provider Fiserv Inc. introduced its own fiat-backed token to help smaller financial institutions keep pace with payment innovation. Article contentStill, displacing card networks won’t be easy, especially in the US, where consumers are used to rewards, fraud protection and credit access — perks not easily replaced. Stablecoins offer limited advantages at the checkout and, for many, crypto remains unfamiliar or suspect. Stablecoin balances aren’t expected to carry FDIC insurance, and consumer protections may differ sharply from regular cards. For merchants, new technology may bring compliance, tax and operational risks. Article contentDigital proponents are pressing ahead, regardless. Shopify Inc. recently partnered with Stripe Inc. and Coinbase Global Inc. to let merchants accept USDC, a dollar-backed stablecoin from Circle. Behind the scenes, the payment can take place without ever touching a card network. Instead, it’s processed entirely on a blockchain protocol, which allows merchants to accept USDC directly into their own crypto wallets or instantly convert it into local currency paid out to their bank account. Article contentShopify will be offering 1% cash-back to customers who pay with USDC. The rewards will also be paid in USDC. Coinbase has launched its own payments platform to enable stablecoin acceptance across more e-commerce providers. Article content Article content“It’s hard to change consumer payment preferences but, unlike in the past, the wheels are in motion for a dramatic shift in consumer payment preferences,” said Richard Crone, chief executive officer of payments consulting firm, Crone Consulting. Article contentThat pressure is forcing Visa and Mastercard, which combined hold more than 85% of total US card spending, to go on the offense. Both are promoting their global merchant reach, fraud protection, consumer privacy and brand trust. The networks’ tokenization technology, for example, obscures sensitive account information to protect consumers when they buy online. Article content“We’ve been tokenizing access to value for a very long time now,” said Jack Forestell, chief product and strategy officer at Visa. “Now the value that underlies that token, by and large, is either bank accounts or credit lines, debit and credit cards, but there’s absolutely no reason that can’t be a stablecoin or another cryptocurrency.”Article contentDigital FutureArticle contentBoth networks have dabbled with integrating stablecoin into their ecosystems since at least 2021, but the renewed energy around the technology is pushing those efforts back into the spotlight, and spurring greater investments. Visa Ventures, for example, invested in stablecoin infrastructure provider BVNK earlier this year. Financial institutions can use a platform from the network to issue fiat-backed digital tokens. Article content Article contentMastercard recently announced it’s joining the Paxos Global Dollar Network, allowing Paxos to help institutions on its network mint and redeem a stablecoin known as USDG, while also providing support for stablecoins including Fiserv’s FIUSD, PayPal’s PYUSD and Circle’s USDC. Article contentThe network also gives users detailed control over how payments are routed. A transaction under $100 might draw from a checking account, larger ones from credit lines, and certain merchants from a crypto wallet — all tied to a single payment identity.Article content“We shouldn’t assume that overnight, stablecoins will replace existing card payments or fiat,” said Jorn Lambert, chief product officer at Mastercard. “We think this is much more about new use cases and new opportunities than about replacing the existing system, especially in remittances, disbursements and business-to-business payments.”Article contentVisa’s Forestell notes that every prior disruption — from mobile wallets to buy-now-pay-later — triggered similar warnings. In the end, corporate adaptation won out.Article content“When you’re crypto natives, you can send money back and forth, but if you want to use that in a broad scale manner for your everyday purposes, you need that hyperscale connectivity, and we provide the best on-ramp to that,” Forestell said. Article content(Updates with additional context on stablecoin investments throughout)Article content